Tottenham and Real Madrid once had a brief and somewhat unbalanced partnership. The future ownership of Daniel Levy’s club may now be indirectly impacted by the Spanish powerhouses.

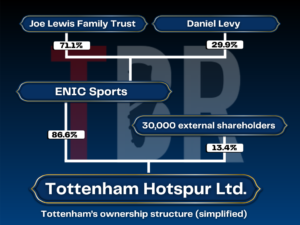

Levy, who owns a 29% stake in Spurs, has been searching for new investors for a while, though the search was only formally confirmed in April of last year.

Although it appears that minority investment in Tottenham is currently the more likely option, it is unclear how much equity, if any, the divisive chairman is willing to sell.

Since the North London club hired the Rothschild bank to investigate possible buyers, there has been a fair amount of noise. The only organization known to have communicated with the club is Amanda Staveley’s PCP Capital Partners, though it’s unclear how those discussions turned out.

Levy and ENIC’s search for potential partners is likely being hampered by the current high level of competition in the Premier League football mergers and acquisitions market.

Although Dan Friedkin’s acquisition of Everton is now final, negotiations are still ongoing to sell minority stakes in West Ham, Wolves, Brentford, Bournemouth, and Crystal Palace.

With yearly revenues of £550 million as of the most recent count, Spurs are financially in a different league than those clubs, but the current N17 slump isn’t exactly helping their cause.

Ange Postecoglou’s team is experiencing freefall. Their 3-2 defeat to Everton at the weekend was their sixth league game without a win.

The manager may normally be under more pressure than he is at the moment. Levy was the target of mocking chants at Goodison Park on Sunday, but the Australian is by no means out of the running.

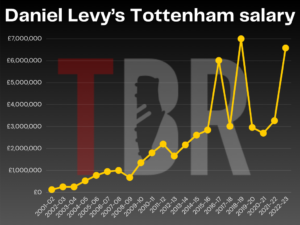

In his 25 years as manager, Levy has completely changed the club at Hotspur Way in Enfield, but there is increasing agreement that he has done as much as he can.

The 62-year-old, the face of Tottenham, was originally only expected to serve as chairman on an interim basis. He was previously the head of private equity and an investment banker.

In the context of contemporary football, players and managers are expected to be the stars. But it’s not a special circumstance.

Florentino Perez scuttles things while Daniel Levy looks for minority funding.

Born on March 8, 1947, Florentino Pérez Rodríguez is a Spanish businessman who serves as the chairman and CEO of Grupo ACS, a civil engineering firm, and president of Real Madrid. Many people consider him to be the best president of all time and he is well acquainted with Levy.

They have had some difficult talks regarding the sales of Gareth Bale and Luka Modric to Real Madrid, in addition to cooperating on the European Super League uprising.

The billionaire Perez, who made his fortune in construction, has even claimed that Levy texted him to congratulate him on winning the Champions League with his players following Real Madrid’s victories.

In the football finance industry, however, it is widely believed that they have a solid professional relationship and that any teasing between them is amicable. Instead of being the president of a private company, Perez is the president of a club with members. This implies that he lacks the authority to seek private investment in the club, in contrast to Levy.

But in November of last year, it was revealed that the 77-year-old was running for reelection with a platform that might allow the club to attract historic outside funding.

Price of Football author and Liverpool University football finance lecturer Kieran Maguire implied that Perez’s plans were bad news for Levy in an exclusive interview with TBR Football.

“Real Madrid basically have guaranteed participation in the Champions League, whereas Spurs don’t. So they are much more de-risked than Spurs,” he said.

“I admire Spurs and I think they perhaps have a higher upside than Real Madrid. But if I was advising someone who wants a high-profile, low-risk investment opportunity, I would go for Real Madrid.

“I’m no fan of Florentino Perez, but I think there is more potential to leverage the international appeal of Real Madrid more.“

Real Madrid has now declared that Perez has been re-elected for a fifth term as president, paving the way for him to pursue his ambitions of attracting private investment in the 15-time European champions. Equity is only ever available for purchase at a select few top football teams, and Spurs will face additional competition if another club goes up for sale.

Could Ligue 1’s mass exodus provide Tottenham with its next co-owner?

Events in France may cause a rush to invest in clubs outside of Ligue 1, even though the Perez situation may have closed one or two doors in the world of investments.

French football is currently in crisis because the league’s leaders have greatly overestimated the value of their TV rights, which are by far the largest source of revenue for their clubs.

In 2024–2025, Ligue waited until the last minute to negotiate a broadcast deal, and even then, it was less than half of the £1 billion they had hoped for. Even worse, the broadcaster DAZN, which purchased the majority of the TV rights, is now attempting to reduce the deal to less than £340 million.

Additionally, the sponsorship guarantee from their contract with the league has been cut by Ligue’s other broadcaster, beIN SPORTS, which could result in a 20% decline in value.

When the news of the crisis was at its most apocalyptic, the mood music of the summer implied that this might lead to a mass exodus of French owners to other parts of Europe. If so, it might increase the number of investors keeping an eye on Spurs.